CleanTech clarifies technical disclosure on the El Triunfo Gold-Antimony Project in Bolivia

Vancouver, British Columbia, April 17, 2025 — CleanTech Vanadium Mining Corp. (“CleanTech” or the “Company”) (TSX-V: CTV, OTCQB: CTVFF) is pleased to announce that it has identified multiple occurrences of antimony in select drill core from the El Triunfo gold and antimony project (the “Triunfo Project”) located 75 km east of La Paz city, Bolivia.

While conducting due diligence on the Triunfo Project drillhole database, the Company observed several intervals of antimony mineralization from nine inspected diamond-drill-holes recently drilled in 2020 and 2022. The assays of the drill holes are tabulated below. All nine drill holes contained several intersections of antimony grading higher than 0.1%. Hole TR010 contained 1.2-meter intersection grading over 1% antimony.

| Significant Drilling Program Intervals at the Triunfo Project | |||||||

| Hole ID | From | To | Width | True Width | Au | Ag | Sb |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | |

| TR004 | 70.00 | 71.00 | 1.00 | 0.77 | 0.01 | 1.25 | 0.15 |

| TR004 | 71.00 | 72.00 | 1.00 | 0.77 | 0.37 | 7.76 | 0.12 |

| TR004 | 72.00 | 73.00 | 1.00 | 0.77 | 1.51 | 2.67 | 0.01 |

| TR004 | 73.00 | 74.00 | 1.00 | 0.77 | 0.41 | 4.59 | 0.39 |

| TR004 | 101.90 | 102.50 | 0.60 | 0.46 | 0.13 | 11.85 | 0.09 |

| TR004 | 102.50 | 103.50 | 1.00 | 0.77 | 0.03 | 0.80 | 0.01 |

| TR004 | 123.50 | 124.50 | 1.00 | 0.77 | 0.00 | 1.48 | 0.02 |

| TR004 | 131.50 | 132.50 | 1.00 | 0.77 | 0.01 | 2.99 | 0.01 |

| TR005 | 58.00 | 59.00 | 1.00 | 0.94 | 0.00 | 0.38 | 0.04 |

| TR005 | 61.00 | 62.00 | 1.00 | 0.94 | 0.40 | 8.00 | 0.03 |

| TR005 | 62.00 | 63.00 | 1.00 | 0.94 | 0.04 | 3.53 | 0.84 |

| TR005 | 63.00 | 64.00 | 1.00 | 0.94 | 0.00 | 0.61 | 0.15 |

| TR005 | 64.00 | 66.00 | 2.00 | 1.88 | 0.01 | 0.14 | 0.02 |

| TR006 | 94.50 | 95.00 | 0.50 | 0.47 | 1.63 | >100 | 0.01 |

| TR006 | 190.50 | 191.30 | 0.80 | 0.75 | 0.20 | 76.20 | 0.01 |

| TR008 | 46.00 | 47.00 | 1.00 | 0.94 | 0.36 | 79.30 | 0.01 |

| TR008 | 47.00 | 47.75 | 0.75 | 0.94 | 5.13 | >100 | 0.02 |

| TR008 | 72.00 | 73.00 | 1.00 | 0.94 | 0.02 | 88.90 | 0.03 |

| TR008 | 75.00 | 76.00 | 1.00 | 0.94 | 0.06 | 54.30 | 0.02 |

| TR008 | 77.00 | 78.00 | 1.00 | 0.94 | 0.02 | 3.41 | 0.07 |

| TR008 | 78.00 | 79.00 | 1.00 | 0.94 | 0.02 | 20.00 | 0.10 |

| TR008 | 79.00 | 80.00 | 1.00 | 0.94 | 0.01 | 3.22 | 0.04 |

| TR008 | 81.00 | 82.00 | 1.00 | 0.94 | 0.01 | 1.90 | 0.01 |

| TR008 | 82.00 | 83.00 | 1.00 | 0.94 | 0.04 | 11.15 | 0.10 |

| TR008 | 83.00 | 84.00 | 1.00 | 0.94 | 0.08 | 18.20 | 0.04 |

| TR008 | 247.50 | 248.50 | 1.00 | 0.94 | 1.87 | 63.50 | 0.02 |

| TR009 | 154.00 | 155.00 | 1.00 | 0.91 | 0.11 | >100 | 0.04 |

| TR009 | 155.00 | 156.00 | 1.00 | 0.91 | 0.03 | >100 | 0.02 |

| TR009 | 169.00 | 170.00 | 1.00 | 0.91 | 0.24 | >100 | 0.02 |

| TR009 | 173.00 | 174.00 | 1.00 | 0.91 | 0.11 | >100 | 0.01 |

| TR009 | 174.00 | 175.00 | 1.00 | 0.91 | 0.27 | 88.20 | 0.02 |

| TR009 | 175.00 | 176.00 | 1.00 | 0.91 | 1.92 | 32.50 | 0.02 |

| TR009 | 206.00 | 207.00 | 1.00 | 0.91 | 0.02 | 8.11 | 0.02 |

| TR009 | 226.00 | 227.00 | 1.00 | 0.91 | 0.02 | 3.33 | 0.01 |

| TR010 | 31.00 | 33.00 | 2.00 | 1.73 | 0.01 | 3.45 | 0.14 |

| TR010 | 37.00 | 39.00 | 2.00 | 1.73 | 0.00 | 1.23 | 0.04 |

| TR010 | 39.00 | 39.60 | 0.60 | 0.52 | 0.01 | 4.41 | 0.31 |

| TR010 | 39.60 | 40.80 | 1.20 | 1.04 | 0.30 | 61.40 | >1 |

| TR010 | 40.80 | 42.00 | 1.20 | 1.04 | 0.00 | 1.10 | 0.03 |

| TR010 | 42.00 | 44.00 | 2.00 | 1.73 | 0.00 | 1.09 | 0.03 |

| TR010 | 44.00 | 46.00 | 2.00 | 1.73 | 0.00 | 2.31 | 0.14 |

| TR010 | 46.00 | 48.00 | 2.00 | 1.73 | 0.00 | 1.50 | 0.05 |

| TR010 | 117.00 | 118.00 | 1.00 | 0.87 | 0.00 | 0.79 | 0.01 |

| TR010 | 149.00 | 150.00 | 1.00 | 0.87 | 0.34 | 4.42 | 0.05 |

| TR010 | 239.00 | 240.00 | 1.00 | 0.87 | 0.02 | 5.22 | 0.01 |

| TR011 | 199.00 | 200.00 | 1.00 | 0.87 | 0.09 | >100 | 0.01 |

| TR011 | 218.00 | 219.00 | 1.00 | 0.87 | 0.13 | 75.00 | 0.01 |

| TR011 | 229.00 | 230.00 | 1.00 | 0.87 | 0.02 | 99.70 | 0.10 |

| TR011 | 247.00 | 248.00 | 1.00 | 0.87 | 0.01 | 5.71 | 0.01 |

| TR012 | 260.00 | 261.00 | 1.00 | 0.71 | 0.05 | 7.14 | 0.08 |

| TR013 | 77.00 | 78.00 | 1.00 | 0.71 | 0.16 | 92.80 | 0.01 |

| TR013 | 85.20 | 86.00 | 0.80 | 0.57 | 0.00 | 67.60 | 0.01 |

| TR013 | 86.00 | 86.60 | 0.60 | 0.42 | 0.02 | 49.40 | 0.14 |

| TR013 | 86.60 | 88.00 | 1.40 | 0.99 | 0.00 | 5.22 | 0.02 |

| TR013 | 88.00 | 89.00 | 1.00 | 0.71 | 0.46 | 6.30 | 0.31 |

| TR013 | 89.00 | 90.00 | 1.00 | 0.71 | 0.01 | 6.12 | 0.29 |

| TR013 | 90.00 | 91.00 | 1.00 | 0.71 | 0.01 | 1.97 | 0.15 |

| TR013 | 93.00 | 94.00 | 1.00 | 0.71 | 0.02 | 6.58 | 0.11 |

| TR013 | 254.00 | 255.00 | 1.00 | 0.71 | 0.03 | 15.05 | 0.04 |

| TR013 | 260.00 | 261.00 | 1.00 | 0.71 | 0.01 | 15.60 | 0.01 |

| TR013 | 265.00 | 267.00 | 2.00 | 1.41 | 0.00 | 8.13 | 0.02 |

| TR013 | 286.00 | 287.10 | 1.10 | 0.78 | 0.21 | 7.89 | 0.01 |

| TR013 | 287.70 | 288.45 | 0.75 | 0.53 | 0.20 | 18.85 | 0.02 |

| TR013 | 288.45 | 289.00 | 0.55 | 0.39 | 0.01 | 9.33 | 0.05 |

| TR013 | 289.00 | 290.00 | 1.00 | 0.71 | 0.02 | 8.61 | 0.04 |

The Company is highly encouraged by the antimony results and will continue to evaluate this potential by reviewing and assaying prior historic drill core. The Company is optimistic about exploring Triunfo Project’s potential to meet the increasing demand in critical sectors like energy storage, military and industrial alloy manufacturing.

Antimony price has reached over US$40,000 per ton in 2025 representing over a 250% increase since January 2024 according to S&P Global[1]. This surge follows China’s announcement on January 1, 2025, restricting antimony exports to the United States as part of broader controls on critical minerals, including antimony, gallium, and germanium.

Antimony is a crucial material in flame retardants, lead-acid batteries, ammunition, and various metal alloys critical for industrial and defense applications.

According to the U.S. Geological Survey[2], global annual antimony production was approximately 83,000 metric tons in 2023. China currently dominates global antimony supply, accounting for around 50% of total production and most of the world’s exports. The United States currently has no domestic antimony production and relies entirely on imports to meet its antimony requirements. Bolivia produces approximately 3,000 metric tons of antimony annually, accounting for about 3.6% of global supply according to USGS.

About the El Triunfo Project:

CleanTech entered into an Option Assignment Agreement with Silver Elephant Mining Corp. (“Silver Elephant”) on April 8, 2025 pursuant to which Silver Elephant proposes to assign its rights to an option agreement dated July 10, 2020 (the “Triunfo Option Agreement”) to acquire 100% of the equity interests in the capital of Mururata S.R.L. a commercial society existing pursuant to the laws of Bolivia, which owns certain Bolivian mining rights that comprise the El Triunfo Project to CleanTech in consideration for the payment of CAD 155,000 in cash (the “Transaction”).

Closing of the Transaction is subject to the satisfaction of certain conditions precedent thereto including, without limitation, satisfactory completion of due diligence in respect of the Triunfo Project by CleanTech, the receipt of the requisite regulatory and stock exchange approvals by each of Silver Elephant and CleanTech, and the execution of an amendment to the Triunfo Option Agreement in form and substance acceptable to CleanTech. CleanTech paid Silver Elephant a refundable deposit in the amount of $155,000 which deposit shall be repaid in the event the Transaction is not completed by December 31, 2025 or if the Triunfo Option Assignment Agreement is otherwise terminated.

Triunfo Project drilling results (drilling conducted by Silver Elephant):

| Triunfo Project 2020 Drill Program Significant Gold Intervals | |||||||||

| Hole ID | From | To | Width | True Width | Au | Ag | Zn | Pb | |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | ||

| TR004 | 14.00 | 15.00 | 1.00 | 0.77 | 0.24 | 18.85 | 0.21 | 0.65 | |

| 17.00 | 18.00 | 1.00 | 0.77 | 0.74 | 2.21 | 0.03 | 0.04 | ||

| 71.00 | 74.00 | 3.00 | 2.30 | 1.11 | 5.01 | 0.00 | 0.00 | ||

| TR005 | 61.00 | 62.00 | 1.00 | 0.94 | 0.59 | 8.00 | 0.00 | 0.01 | |

| 122.00 | 124.00 | 2.00 | 1.88 | 0.50 | 2.29 | 0.01 | 0.02 | ||

| TR006 | 5.00 | 6.00 | 1.00 | 0.94 | 0.73 | 3.19 | 0.10 | 0.13 | |

| 20.00 | 21.00 | 1.00 | 0.94 | 0.15 | 11.10 | 0.35 | 0.29 | ||

| 40.00 | 76.00 | 36.00 | 33.83 | 0.49 | 15.46 | 0.54 | 0.44 | ||

| including… | 58.00 | 72.00 | 14.00 | 13.15 | 0.48 | 20.23 | 0.76 | 0.66 | |

| TR006 | 94.50 | 101.50 | 7.00 | 6.58 | 0.56 | 23.21 | 0.82 | 0.56 | |

| 106.50 | 107.40 | 0.80 | 0.75 | 0.32 | 12.70 | 0.25 | 0.01 | ||

| 120.00 | 121.00 | 1.00 | 0.94 | 0.07 | 15.90 | 0.50 | 0.67 | ||

| 142.80 | 143.30 | 0.50 | 0.47 | 0.60 | 0.43 | 0.00 | 0.00 | ||

| 190.00 | 191.30 | 1.30 | 1.22 | 0.72 | 89.58 | 2.07 | 0.16 | ||

| TR007 | 13.00 | 111.90 | 98.90 | 85.65 | 0.37 | 22.71 | 0.74 | 0.58 | |

| including… | 63.00 | 111.90 | 48.90 | 42.35 | 0.42 | 35.49 | 1.17 | 0.83 | |

| TR007 | 118.50 | 119.50 | 1.00 | 0.87 | 0.03 | 4.55 | 0.17 | 0.53 | |

| 121.50 | 122.50 | 1.00 | 0.87 | 0.30 | 3.69 | 0.07 | 0.46 | ||

| 125.50 | 126.30 | 0.80 | 0.69 | 0.56 | 3.18 | 0.09 | 0.03 | ||

| 179.00 | 181.00 | 2.00 | 1.73 | 1.05 | 1.38 | 0.01 | 0.01 | ||

| 185.60 | 186.20 | 0.60 | 0.52 | 0.44 | 5.69 | 0.02 | 0.01 | ||

| 196.00 | 197.00 | 1.00 | 0.87 | 0.74 | 1.46 | 0.00 | 0.00 | ||

| TR008 | 6.80 | 84.00 | 77.30 | 72.63 | 0.31 | 17.65 | 0.57 | 0.53 | |

| including… | 45.00 | 51.40 | 6.40 | 6.01 | 1.60 | 56.49 | 1.66 | 0.94 | |

| TR008 | 138.10 | 139.10 | 1.00 | 0.94 | 0.71 | 0.90 | 0.01 | 0.00 | |

| 149.00 | 151.00 | 2.00 | 1.88 | 0.10 | 22.73 | 0.78 | 0.03 | ||

| 156.00 | 157.00 | 1.00 | 0.94 | 0.74 | 1.33 | 0.02 | 0.01 | ||

| 183.00 | 183.60 | 0.60 | 0.56 | 1.65 | 2.62 | 0.02 | 0.01 | ||

| 231.60 | 232.60 | 1.00 | 0.94 | 0.41 | 4.50 | 0.00 | 0.00 | ||

| 247.50 | 250.00 | 2.50 | 2.35 | 1.64 | 35.99 | 0.00 | 0.00 | ||

| 257.00 | 258.00 | 1.00 | 0.94 | 0.78 | 2.15 | 0.00 | 0.00 | ||

| Triunfo Project 2022 Drill Program Significant Gold Intervals | |||||||||

| Hole ID | From | To | Width | True Width | Au | Ag | Pb | Zn | |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | ||

| TR009 | 3.00 | 250.00 | 247.00 | 223.86 | 0.20 | 8.10 | 0.17 | 0.14 | |

| incl… | 46.00 | 47.00 | 1.00 | 0.91 | 0.40 | 1.70 | 0.01 | 0.00 | |

| …and | 109.00 | 115.00 | 6.00 | 5.44 | 0.50 | 1.90 | 0.02 | 0.00 | |

| …and | 137.00 | 138.00 | 1.00 | 0.91 | 0.40 | 18.30 | 0.70 | 0.14 | |

| …and | 154.00 | 156.00 | 2.00 | 1.81 | 0.20 | 211.00 | 0.84 | 0.24 | |

| …and | 164.00 | 178.00 | 14.00 | 12.69 | 0.80 | 65.00 | 1.74 | 1.44 | |

| …and | 193.00 | 197.00 | 4.00 | 3.63 | 1.20 | 2.10 | 0.04 | 0.01 | |

| …and | 232.00 | 236.00 | 4.00 | 3.63 | 2.40 | 12.90 | 0.19 | 0.04 | |

| TR010 | 7.00 | 52.00 | 45.00 | 38.97 | 0.30 | 8.70 | 0.58 | 0.40 | |

| incl… | 24.00 | 25.00 | 1.00 | 0.87 | 1.80 | 27.00 | 0.81 | 1.25 | |

| …and | 39.60 | 40.80 | 1.20 | 1.04 | 2.40 | 61.40 | 10.80 | 2.98 | |

| TR010 | 144.00 | 151.00 | 7.00 | 6.06 | 0.40 | 2.40 | 0.00 | 0.00 | |

| TR010 | 190.00 | 192.00 | 2.00 | 1.73 | 0.90 | 4.60 | 0.05 | 0.03 | |

| TR010 | 219.00 | 221.00 | 2.00 | 1.73 | 0.60 | 5.30 | 0.01 | 0.04 | |

| TR010 | 237.00 | 245.00 | 8.00 | 6.93 | 0.40 | 4.50 | 0.04 | 0.04 | |

| incl… | 241.00 | 243.00 | 2.00 | 1.73 | 1.10 | 5.00 | 0.01 | 0.01 | |

| TR010 | 290.00 | 291.00 | 1.00 | 0.87 | 0.30 | 95.30 | 1.96 | 0.20 | |

| TR011 | 2.00 | 300.10 | 298.10 | 258.15 | 0.06 | 2.80 | 0.06 | 0.05 | |

| incl… | 195.00 | 242.00 | 47.00 | 40.70 | 0.18 | 12.90 | 0.31 | 0.22 | |

| …and | 197.00 | 201.00 | 4.00 | 3.46 | 0.34 | 46.00 | 1.16 | 0.78 | |

| …and | 198.00 | 200.00 | 2.00 | 1.73 | 0.49 | 80.90 | 2.04 | 1.29 | |

| …and | 210.00 | 214.00 | 4.00 | 3.46 | 0.42 | 16.60 | 0.50 | 0.44 | |

| …and | 218.00 | 219.00 | 1.00 | 0.87 | 1.39 | 75.00 | 1.82 | 2.35 | |

| …and | 229.00 | 230.00 | 1.00 | 0.87 | 0.10 | 99.70 | 1.41 | 0.02 | |

| TR012 | 164.00 | 164.50 | 0.50 | 0.35 | 1.04 | 61.40 | 1.87 | 0.84 | |

| …and | 177.00 | 179.00 | 2.00 | 1.41 | 0.94 | 11.40 | 0.30 | 0.21 | |

| …and | 184.00 | 187.50 | 3.50 | 2.47 | 0.32 | 21.70 | 0.67 | 0.28 | |

| …and | 195.00 | 196.00 | 1.00 | 0.71 | 0.34 | 44.60 | 1.15 | 3.04 | |

| …and | 201.00 | 203.00 | 2.00 | 1.41 | 1.50 | 18.80 | 0.52 | 0.32 | |

| …and | 234.00 | 236.00 | 2.00 | 1.41 | 1.54 | 12.10 | 0.47 | 0.76 | |

| TR013 | 64.30 | 90.00 | 25.70 | 18.17 | 0.32 | 22.20 | 0.73 | 0.48 | |

| incl… | 64.30 | 65.00 | 0.70 | 0.49 | 0.52 | 18.50 | 0.54 | 0.72 | |

| …and | 75.00 | 83.00 | 8.00 | 5.66 | 0.76 | 41.10 | 1.45 | 0.98 | |

| …and | 84.00 | 86.60 | 2.60 | 1.84 | 0.13 | 70.30 | 1.72 | 0.68 | |

| …and | 286.00 | 290.00 | 4.00 | 2.83 | 0.41 | 9.40 | 0.31 | 0.77 | |

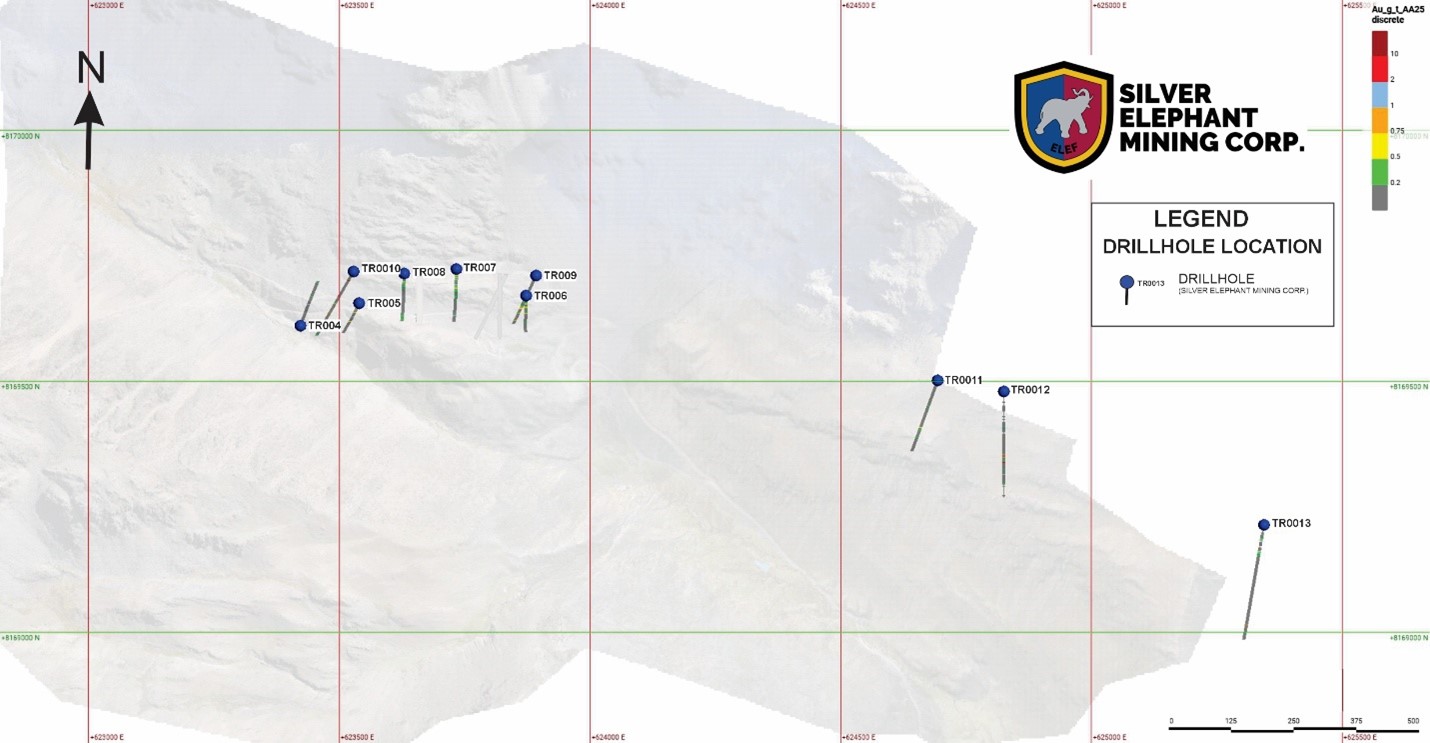

| Triunfo Project Drillholes Location | ||||||

| HOLE_ID | E_UTM | N_UTM | ELEVATION | AZIMUTH | DIP | TOTAL DEPTH |

| (m) | (m) | |||||

| TR004 | 623424 | 8169608 | 4504.0 | 20.0 | -50.0 | 150.0 |

| TR005 | 623539 | 8169656 | 4518.0 | 200.0 | -70.0 | 201.0 |

| TR006 | 623869 | 8169669 | 4505.0 | 180.0 | -70.0 | 201.0 |

| TR007 | 623752 | 8169714 | 4536.0 | 180.0 | -60.0 | 204.0 |

| TR008 | 623654 | 8169712 | 4575.0 | 184.0 | -70.0 | 261.4 |

| TR009 | 623889 | 8169707 | 4518.0 | 205.0 | -65.0 | 250.0 |

| TR010 | 623519 | 8169724 | 4551.0 | 210.0 | -60.0 | 296.0 |

| TR011 | 624693 | 8169502 | 4560.0 | 200.0 | 60.0 | 300.1 |

| TR012 | 624825 | 8169480 | 4578.0 | 180.0 | 45.0 | 300.0 |

| TR013 | 625344 | 8169214 | 4501.0 | 190.0 | -45.0 | 329.0 |

Triunfo Project Drillholes Map

Location & Geology

The Triunfo Project lies within Bolivia’s Cordillera Real, an area with complex geology including Paleozoic metamorphic and igneous formations. This region has experienced multiple tectonic and orogenic (mountain-building) events, creating fractures and faults that host hydrothermal mineral deposits

QA/QC

A Quality Assurance and Quality Control (QA/QC) program consistent with industry standards was implemented during the various drilling campaigns. The procedure involved cutting the core in half and sampling one half, with each sample weighing between 6 and 10 kg. All core and other samples were split, bagged, labeled, and shipped directly to the laboratory.

The laboratory used for analysis was ALS Global, with sample preparation protocol PREP-31, and assays requested for silver (Ag) and 41 elements using the ME-ICP41 method. The remaining 50% of the split sample is securely stored at a dedicated facility. Sample preparation is carried out at the ALS Global laboratory in Oruro, Bolivia, and the analyses are performed at the ALS Global laboratories in Peru or Canada.

Standards and blanks were inserted at regular intervals within each sample batch prior to shipment to the laboratory. These accounted for between 3% and 5% of the analyzed material, depending on the phase of the drilling campaign.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Carlos Zamora,is a member of the American Institute of Professional Geologists (AIPG) and a Certified Professional Geologist (CPG) since 2024. Mr. Zamora is an independent qualified person as defined by National Instrument 43-101.

About CleanTech Vanadium Mining Corp.

CleanTech is an exploration-stage mining company focused on critical mineral resources. The Company owns a 100% interest in the Gibellini Vanadium Mine Project in Nevada, United States and has the right to acquire the El Triunfo gold-antimony project in Bolivia.

Further information on CleanTech can be found at www.cleantechvanadium.com.

ON BEHALF OF THE BOARD

“John Lee”

CEO and Director

For more information about CleanTech, please contact:

Phone: 1.877.664.2535

info@cleantechvanadium.com

www.cleantechvanadium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes,” “may,” “plans,” “will,” “anticipates,” “intends,” “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Such forward-looking information, which reflects management’s expectations regarding CleanTech’s future growth, results of operations, performance, business prospects and opportunities, is based on certain factors and assumptions and involves known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking information. Forward-looking information in this news releases includes: the forward looking market data relating to antimony,that all conditions precedent to the Transaction will be met and the realization of the anticipated benefits derived therefrom for shareholders of each of CleanTech and perception of (i) the quality and the potential of the El Triunfo Project, (ii) the consideration offered by CleanTech for the El Triunfo Project, and (iii) the potential of CleanTech’s businesses following completion of the Transaction. Forward-looking statements are based on the opinions and estimates of management of CleanTech at the date the statements are made and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of CleanTech, there is no assurance they will prove to be correct and are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Forward-looking information involves significant risks and uncertainties, should not be read as a guarantee of future performance, events or results, and may not be indicative of whether such events or results will actually be achieved. A number of risks and other factors could cause actual results to differ materially from expected results discussed in the forward-looking information, including but not limited to: changes in operating plans; ability to secure sufficient financing to advance the Company’s project; conditions impacting the Company’s ability to mine at the project, such as unfavorable weather conditions, development of a mine plan, maintaining existing permits and receiving any new permits required for the project, and other conditions impacting mining generally; maintaining cordial business relations with strategic partners and contractual counter-parties; meeting regulatory requirements and changes thereto; risks inherent to mineral resource estimation, including uncertainty as to whether mineral resources will be further developed into mineral reserves; political risk in the jurisdictions where the Company’s projects are located; commodity price variation; and general market, industry and economic conditions. Additional risk factors are set out in the Company’s latest annual and interim management’s discussion and analysis and annual information form (AIF), available on SEDAR+ at www.sedarplus.ca.

Forward-looking information is based on reasonable assumptions by management as of the date of this news release, and there can be no assurance that actual results will be consistent with any forward-looking information included herein. Readers are cautioned that all forward- looking statements in this news release are made as of the date of this news release. The Company undertakes no obligation to update or revise any forward-looking information in this news release to reflect circumstances or events that occur after the date of this news release, except as required by applicable securities laws.

[1] https://www.spglobal.com/market-intelligence/en/news-insights/research/china-responds-to-us-restrictions-with-export-ban-on-select-critical-minerals

[2] https://www.usgs.gov/centers/national-minerals-information-center/antimony-statistics-and-information